Cryptocurrency news

There are two subcategories of wallets: hot and cold. A hot wallet has a connection to the internet or to a device that has a connection, and a cold wallet has no connection 30 free spins no deposit required keep what you win. Lastly, there are three subcategories of wallets—software, hardware, and paper. Each of these types is considered either a hot or cold wallet.

Wallet safety is essential, as cryptocurrencies are high-value targets for hackers. Some safeguards include encrypting the wallet with a strong password, using two-factor authentication for exchanges, and storing any large amounts you have offline.

Our review process is built around a quantitative rating model that weighs key factors like security, costs, privacy, usability, customer support, and features according to their importance. Our team of researchers gathered over 40 data points and conducted extensive research for each of the 19 companies we reviewed. Our team then test-drove each wallet to lend their qualitative point of view.

Although hot wallets are suitable for daily transactions, for enduring security and substantial investments, cold wallets are the preferred choice. In fact, they are often considered the safest crypto wallet option. The top five cold wallets that stand out for their enhanced security features, extensive coin support, and user-friendly interfaces are:

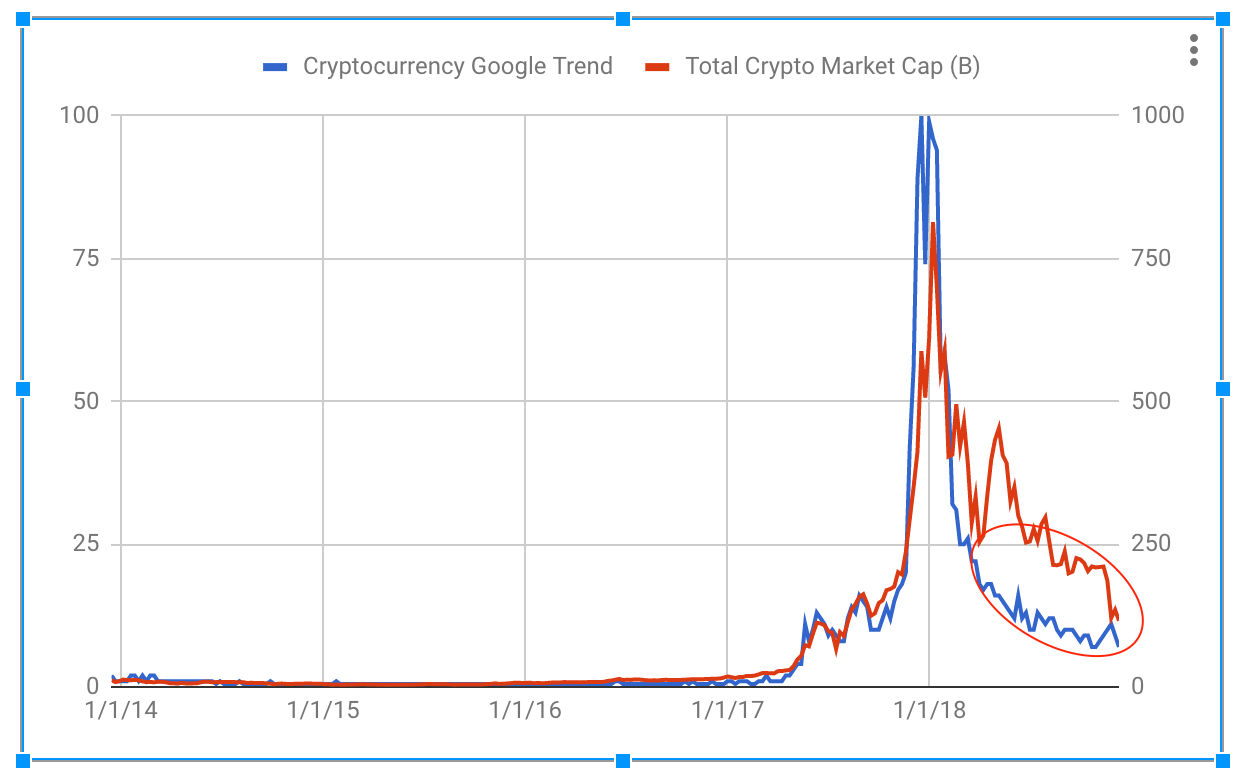

Cryptocurrency prices

The very first cryptocurrency was Bitcoin. Since it is open source, it is possible for other people to use the majority of the code, make a few changes and then launch their own separate currency. Many people have done exactly this. Some of these coins are very similar to Bitcoin, with just one or two amended features (such as Litecoin), while others are very different, with varying models of security, issuance and governance. However, they all share the same moniker — every coin issued after Bitcoin is considered to be an altcoin.

Bitcoin is a peer-to-peer online currency, meaning that all transactions happen directly between equal, independent network participants, without the need for any intermediary to permit or facilitate them. Bitcoin was created, according to Nakamoto’s own words, to allow “online payments to be sent directly from one party to another without going through a financial institution.”

A hard fork is a protocol upgrade that is not backward compatible. This means every node (computer connected to the Bitcoin network using a client that performs the task of validating and relaying transactions) needs to upgrade before the new blockchain with the hard fork activates and rejects any blocks or transactions from the old blockchain. The old blockchain will continue to exist and will continue to accept transactions, although it may be incompatible with other newer Bitcoin clients.

The very first cryptocurrency was Bitcoin. Since it is open source, it is possible for other people to use the majority of the code, make a few changes and then launch their own separate currency. Many people have done exactly this. Some of these coins are very similar to Bitcoin, with just one or two amended features (such as Litecoin), while others are very different, with varying models of security, issuance and governance. However, they all share the same moniker — every coin issued after Bitcoin is considered to be an altcoin.

Bitcoin is a peer-to-peer online currency, meaning that all transactions happen directly between equal, independent network participants, without the need for any intermediary to permit or facilitate them. Bitcoin was created, according to Nakamoto’s own words, to allow “online payments to be sent directly from one party to another without going through a financial institution.”

How to invest in cryptocurrency

By the end of this lesson, you’ll get a better understanding of the ins and outs of crypto and how to navigate the exciting — yet often volatile — world of digital assets. So, buckle up and get ready to explore the potential of cryptocurrency as an investment vehicle. Let’s dive right in!

“Cryptocurrencies are volatile; you have to be able to stomach price swings up and down. Only invest up to an amount that you are willing to lose,” says Stephen Rischall, CFP, partner at wealth management firm Navalign.

You can use these “coins” to buy things online, just like you would with regular money. However, your options of merchants that accept crypto are more limited than those who accept traditional currencies.

Create a robust, rules-based framework. A systematic approach based on predefined criteria helps prevent costly emotion-driven decision-making. Continually refine your portfolio and strategy based on lessons learned. Remain flexible and open to new information rather than rigidly locking yourself into any one system.